by nhe21 | Nov 9, 2023 | Dashboard, Visualization

The history of women’s empowerment in the United Arab Emirates’ social progress is framed by declining fertility rates and a concerted attempt to incorporate women into the workforce. In the midst of this fascinating journey, where the fertility rate has gradually dropped from 4.54% in 1990 to a measured 1.46% in 2021, the United Arab Emirates is at a turning point in its history, overcoming both obstacles and successes as it works toward a future characterized by demographic transitions.

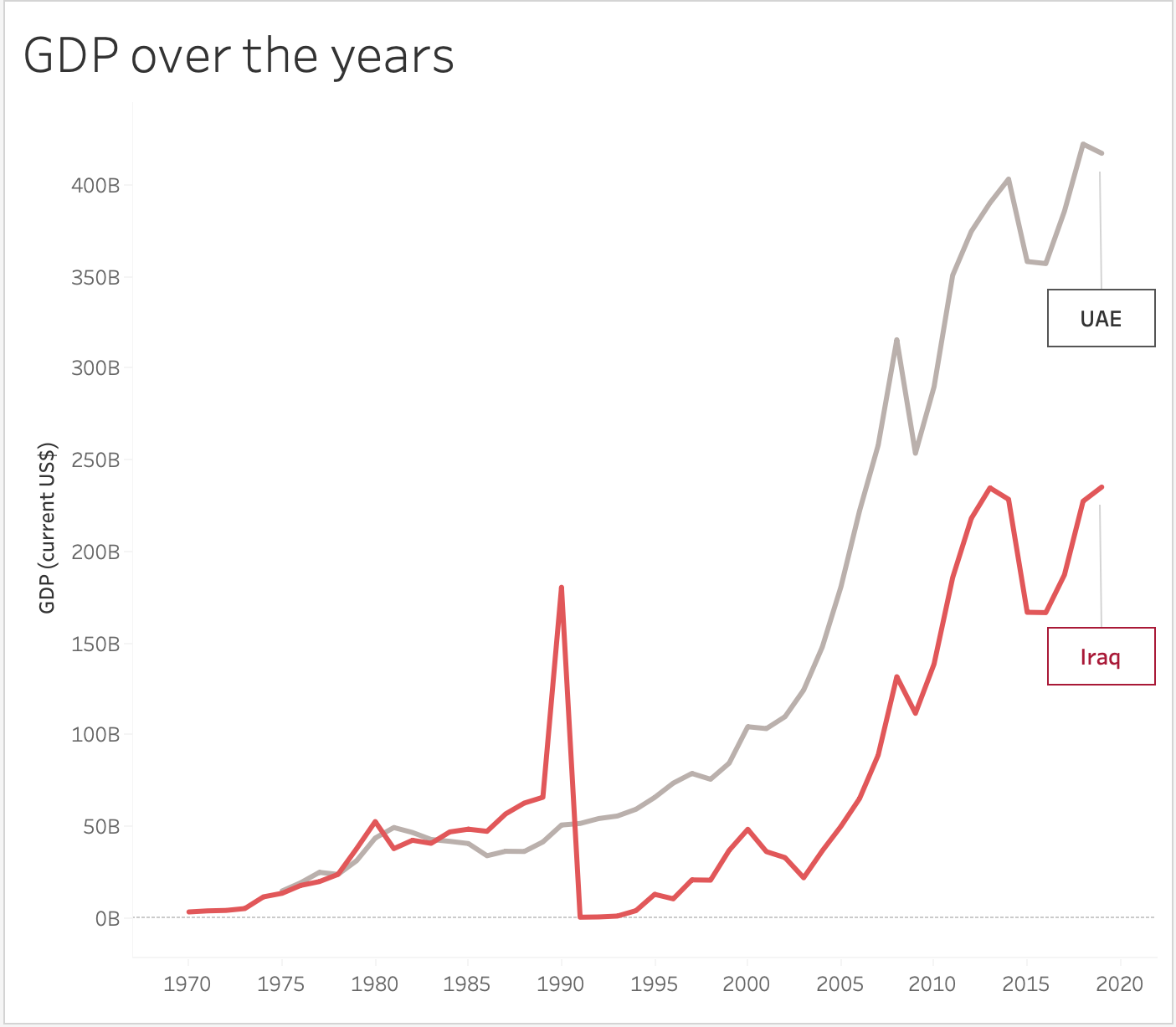

In the face of economic fluctuations, exemplified by a decline in GDP from $417 billion in 2019 to $349 billion in 2020 before peaking at $508B in 2023, UAE remains steadfast in its commitment to stability. This commitment is reflected in the deliberate strides towards gender equality within the workplace, transforming a historical landscape of imbalance. Political leadership, once devoid of female representation at 0% in 1997, has evolved to an inspiring 50% in 2022. Similarly, management roles have seen growth from a modest 12.20% in 2017 to a commendable 23.6% in 2021, portraying a nation charting new territories with determination. Moreover, as shown in the heat map, female percentage of 6.31% among the total female employed population, compared to a male percentage of 4.92% among the total male employed population, the overall self-employment rate stands at 5.15%. This signifies that, in the realm of self-employment, women play a more substantial role, surpassing their male counterparts and collectively making a significant impact on the overall self-employed landscape in the UAE.

To address the challenges faced, a multifaceted approach is recommended. Firstly, actively promoting women’s participation in politics has proven to be transformative, exemplified by successful models achieving 50% female representation in national parliaments. Additionally, supporting and fostering women’s career advancement is crucial, evident in the rising trend of increased female presence in senior and middle management roles. Furthermore, it’s vital to prioritize maintaining healthy fertility rates. This can be achieved through the implementation of comprehensive family-friendly policies, encompassing affordable childcare, flexible work arrangements, and robust support for parental leave. Low fertility rates, prevalent in Western countries, pose significant concerns, and safeguarding against this trend is crucial, especially in the context of an Arab country like the UAE.

This complex journey has not been without its achievements. The increased representation of women in parliamentary roles and senior management positions serves as evidence of the UAE’s holistic approach to women’s empowerment. These accomplishments underscore the significance of an unwavering dedication to gender-inclusive policies, showcasing the nation’s commitment to ensuring continual progress. As the UAE confidently embraces change, it invites the world to witness a seamless blend of demographic adaptability and a resolute embrace of women’s empowerment, illustrating a nation shaping its future with foresight and purpose.

by hmm73 | Nov 8, 2023 | Visualization

The percentage of Food export in Gulf Countries in 2019 is extremely low and the imports is relatively high comparing to exports. Gulf countries exhibited a notable disparity between food exports and imports, with food exports being exceedingly low and food imports substantially higher. Qatar, Kuwait, and Saudi Arabia, in particular, heavily relied on food imports to meet their consumption needs. This underscores a regional dependence on international food sources and highlights the importance of addressing food security to ensure stable access to essential resources in the Gulf.

Impact of Tax rate on Import and Export

The tax rates in Gulf countries as seen in the map can linked to the imports and exports, reveal an interesting correlation. Lower tax rates, such as those in Qatar and Kuwait, can encourage trade and potentially offset their low food exports and high food imports. Conversely, higher tax rates, as seen in Oman, might contribute to higher food import figures. The relatively lower tax rate in the UAE supports its role as a regional trade hub, which is reflected in its balanced import and export figures. The interplay between tax rates and trade statistics underscores the significance of fiscal policies in shaping the trade landscape of these Gulf nation

Agriculture & Industry

Influence of Water Withdrawals in Agriculture and Industry on food imports and exports

The water withdrawals data indicate the extent of agriculture and industrial activity in Gulf countries. Higher agricultural water withdrawals, as seen in Saudi Arabia and Oman, suggest self-sufficiency in food production. Meanwhile, countries with lower agriculture withdrawals, like Kuwait, may rely more on food imports. These water withdrawals can be linked to food import and export dynamics, influencing food security and trade strategies in the region.

Influence of Employment in Agriculture and Industry on food imports and exports

Higher Agricultural Employment & Food Trade:

Oman and Saudi Arabia, with higher agricultural employment, might have a more significant capacity for domestic food production. This could relate to their lower food imports and potential for food exports despite modest industrial growth.

Lower agricultural employment in Bahrain, Kuwait, Qatar, and the UAE could imply a heavier reliance on food imports due to limited domestic agricultural output, aligning with their higher food import figures.

Industrial Employment & Food Trade:

Qatar’s high industrial employment might suggest a lesser emphasis on agriculture, potentially leading to higher food imports despite economic diversification.

Other countries, with varying industrial employment rates, might showcase different levels of agricultural emphasis, influencing their food import-export dynamics.

Solutions

Investment in Agricultural Innovation: Encourage technological advancements and innovation in agriculture to boost productivity, creating more jobs and improving food self-sufficiency..

Tax Reform: Implement tax policies that incentivize investment in both agricultural and industrial sectors, promoting growth and job creation in these areas.

Education and Skills Development: Invest in education and training programs to equip the workforce with the necessary skills for employment in agriculture, industry, and other emerging sectors.

Sustainable Resource Management: Implement sustainable water and land management practices to support agricultural growth without compromising environmental resources, thereby ensuring long-term economic stability.

UN Goals

Goal 8: Decent Work and Economic Growth:

Employment in Agriculture and Industry: The distribution of employment in agriculture and industry reflects the economic structure of countries. Goal 8 emphasizes the importance of decent work and employment opportunities for sustained economic growth.

Food Import-Export Dynamics: Countries with higher agricultural employment might have stronger domestic agricultural sectors, impacting their trade balance in food. Conversely, higher industrial employment might affect the reliance on food imports due to potentially reduced emphasis on agriculture.

Tax Policies: Tax structures impact economic activities and employment opportunities. Favorable tax policies can stimulate growth in both agricultural and industrial sectors, contributing to Goal 8’s aim of fostering economic growth and decent work.

By focusing on inclusive economic growth, job creation, and enhancing productivity in both agriculture and industry, countries can contribute significantly to achieving Goal 8, ensuring sustainable and equitable economic development.

UN Goal Link – Goal 2: Zero Hunger:

Food Import-Export Dynamics: Countries with high food imports or low food exports often face challenges in achieving food security. Goal 2 aims to end hunger, achieve food security, improve nutrition, and promote sustainable agriculture.

Agricultural Practices: Stronger agricultural sectors (linked to lower food imports or higher exports) directly contribute to achieving Goal 2. Sustainable agriculture practices, as encouraged by the goal, can enhance food production and reduce dependency on imports.

by sja38 | Apr 15, 2022 | Visualization

“It is the devil’s excrement. We are drowning in the devil’s excrement. —Juan Pablo Pérez Alfonso, former Venezuelan oil minister”

The narrative fifty years ago

A country discovers vast amounts of oil reserves. Leaders across the world are green with envy.

The underlying assumption

Profits generated from exporting this natural resource, commonly referred to as black gold, transforms a nation from rags to riches.

The narrative today

Rentier states are war-torn, corrupt, and led by dictators whose power is fueled by the sale of this precious commodity.

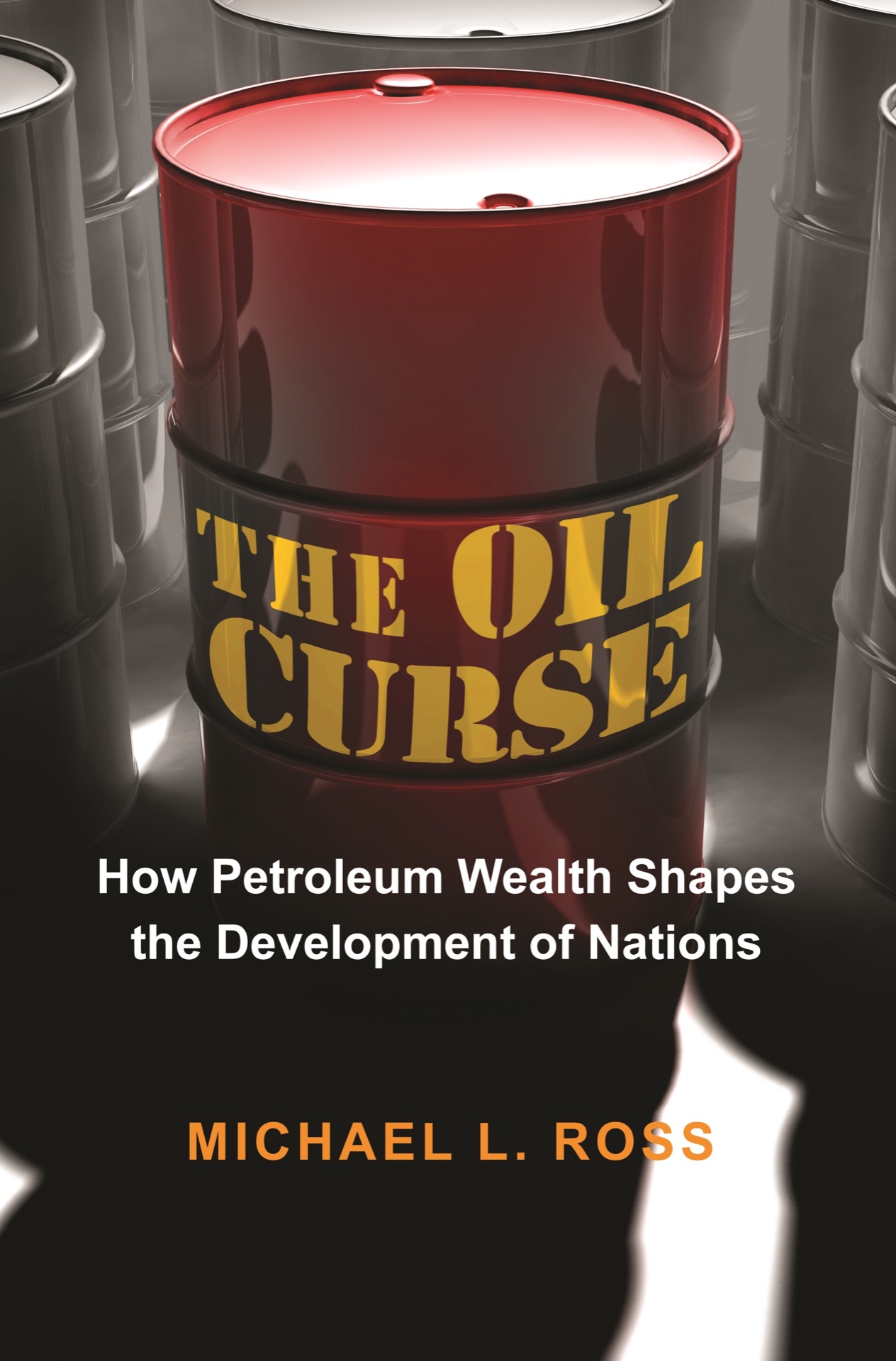

I invite you to read Michael Lewin Ross’ “The Oil Curse”. An excellent resource for those who want to understand why such a valuable commodity leaves its owners worse off than their counterparts.

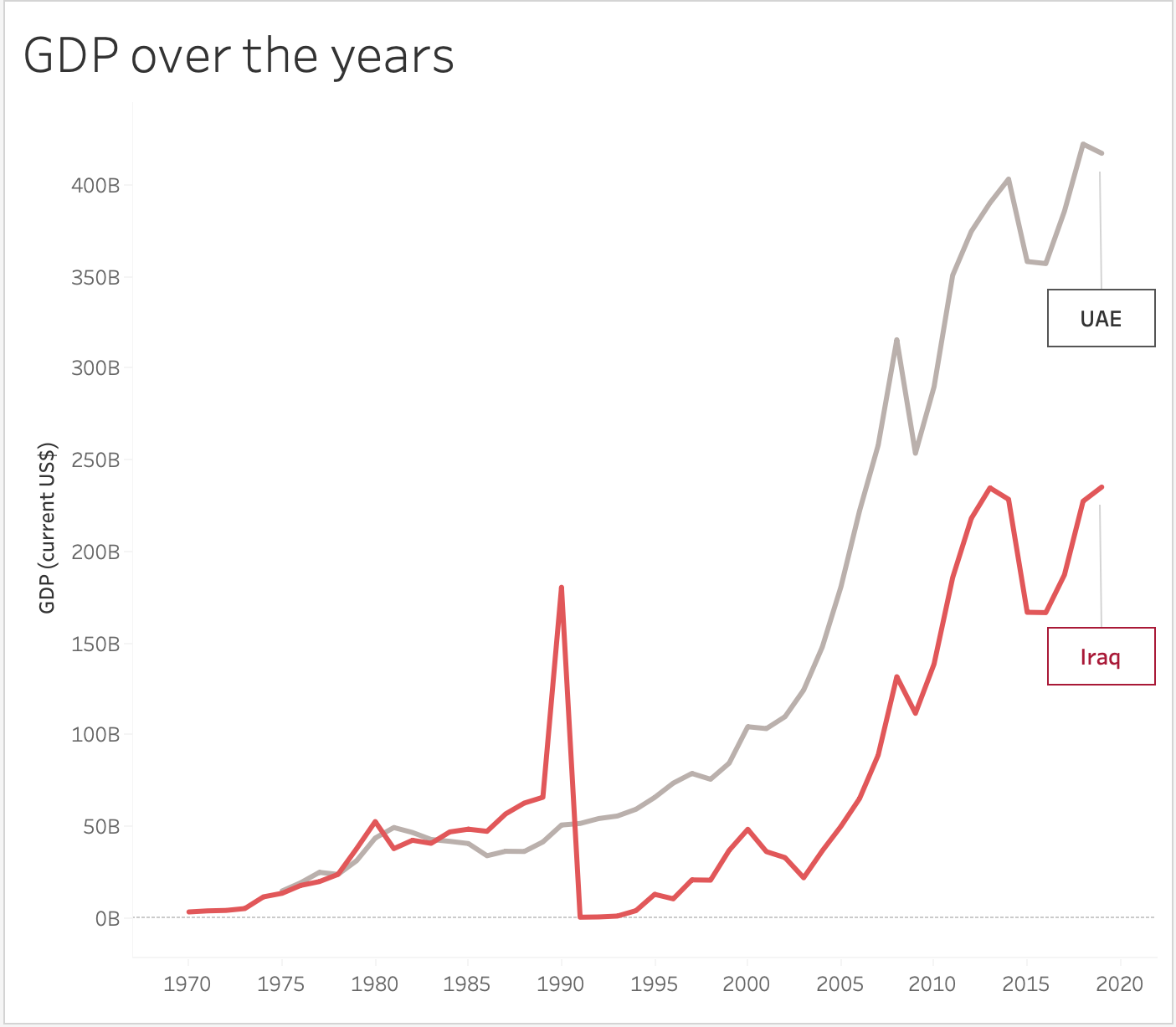

Take Iraq and the United Arab Emirates. Two neighboring countries. Both rich in natural resources. One destroyed by war and conflict. Another a model for quality of life, political stability, and investment. Why are they so different?

The dependencies oil creates on an economy can be catastrophic in the sense that they create patronage systems between the state and its citizens, making it increasingly more difficult to create sustainable economies over time.

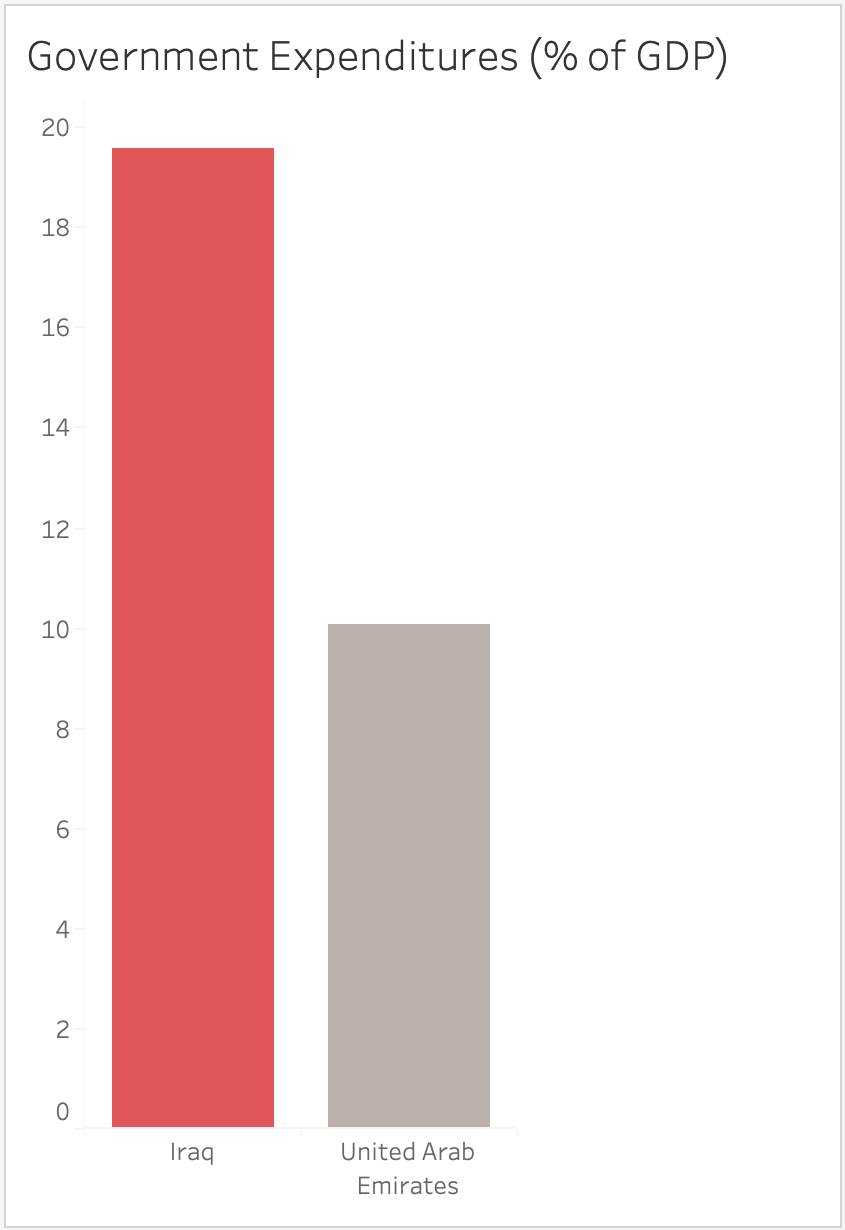

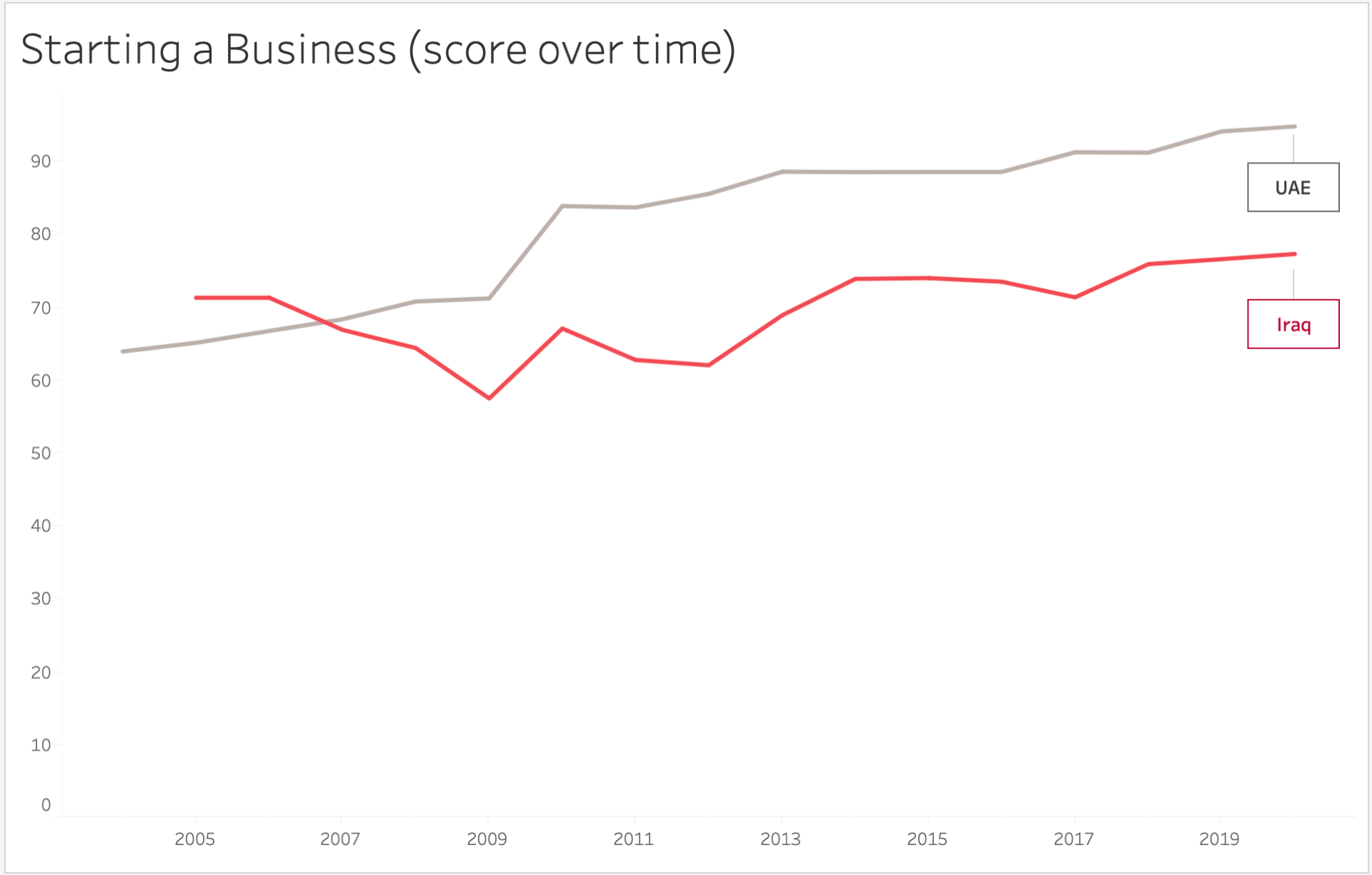

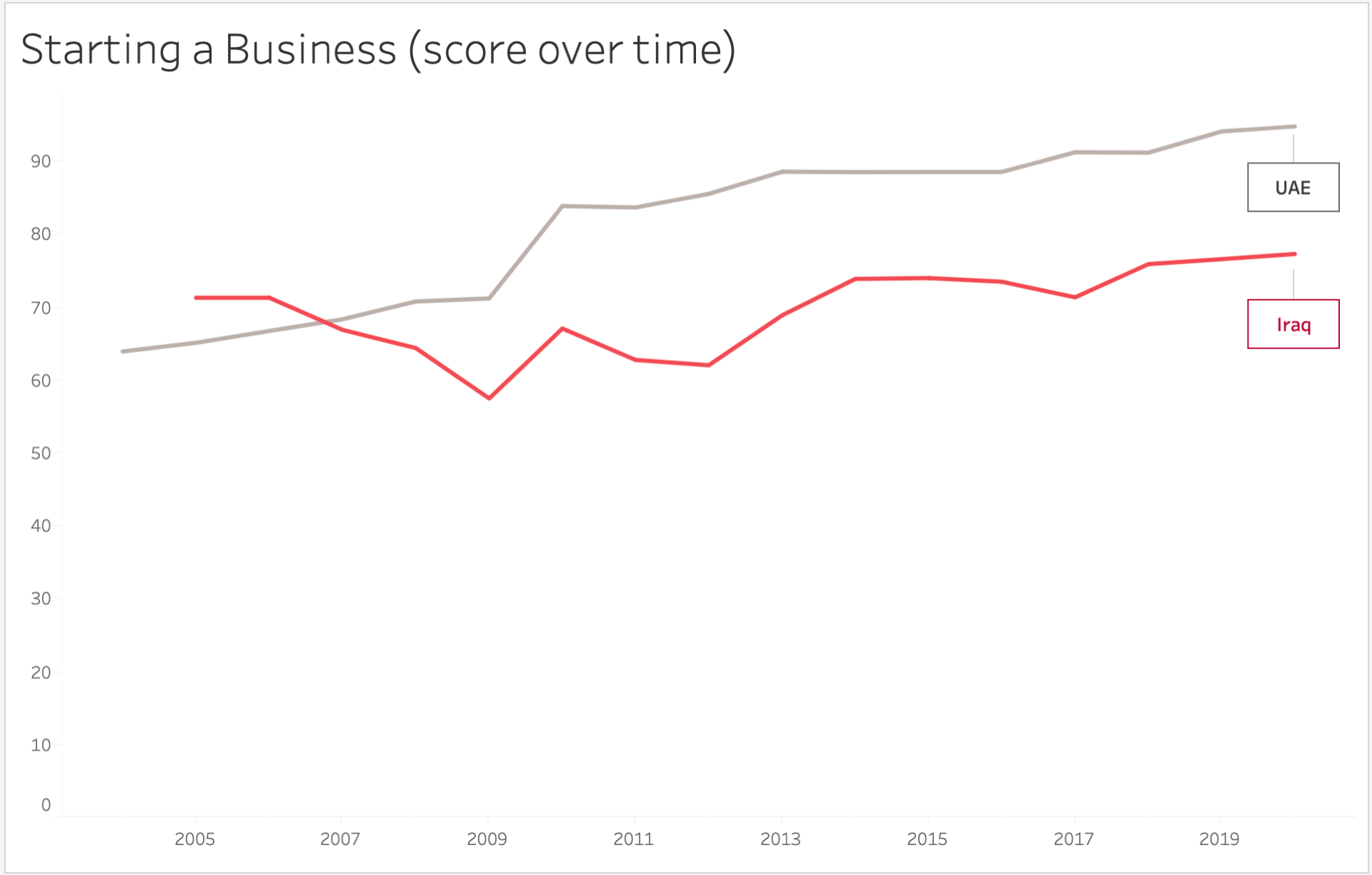

How? The notion that a state is responsible for extracting and selling oil to benefit the country is flawed. Upon exporting oil, Iraq has employed more and more government employees to “pay” its citizens what it owes. The creation of these governmental positions, most of which are redundant in nature, has caused high levels of bureaucracy within each governmental body, making it increasingly more difficult for businesses and start-ups to get their businesses off the ground. Iraq ranks 172nd in the World Bank “Ease of Business” scale. It takes 51 days to register property. It also takes 167 days to deal with construction paperwork and permits. This has had detrimental effects on other industries in Iraq. Iraq’s predominant reliance on oil revenue, coined with electricity shortages, a suffering educational and healthcare system, and an unstable geopolitical climate, makes it increasingly more difficult to wean the average citizen off governmental positions and rations and encourage them to work in the private sector.

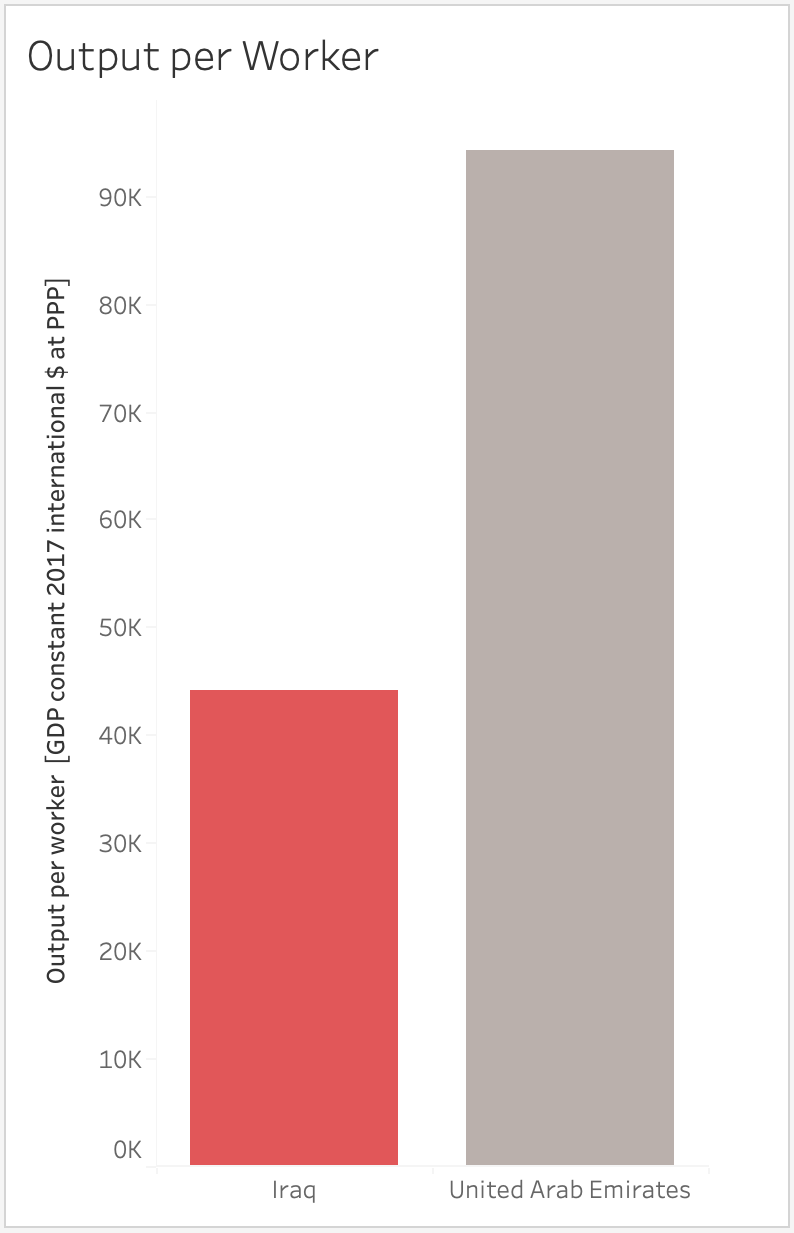

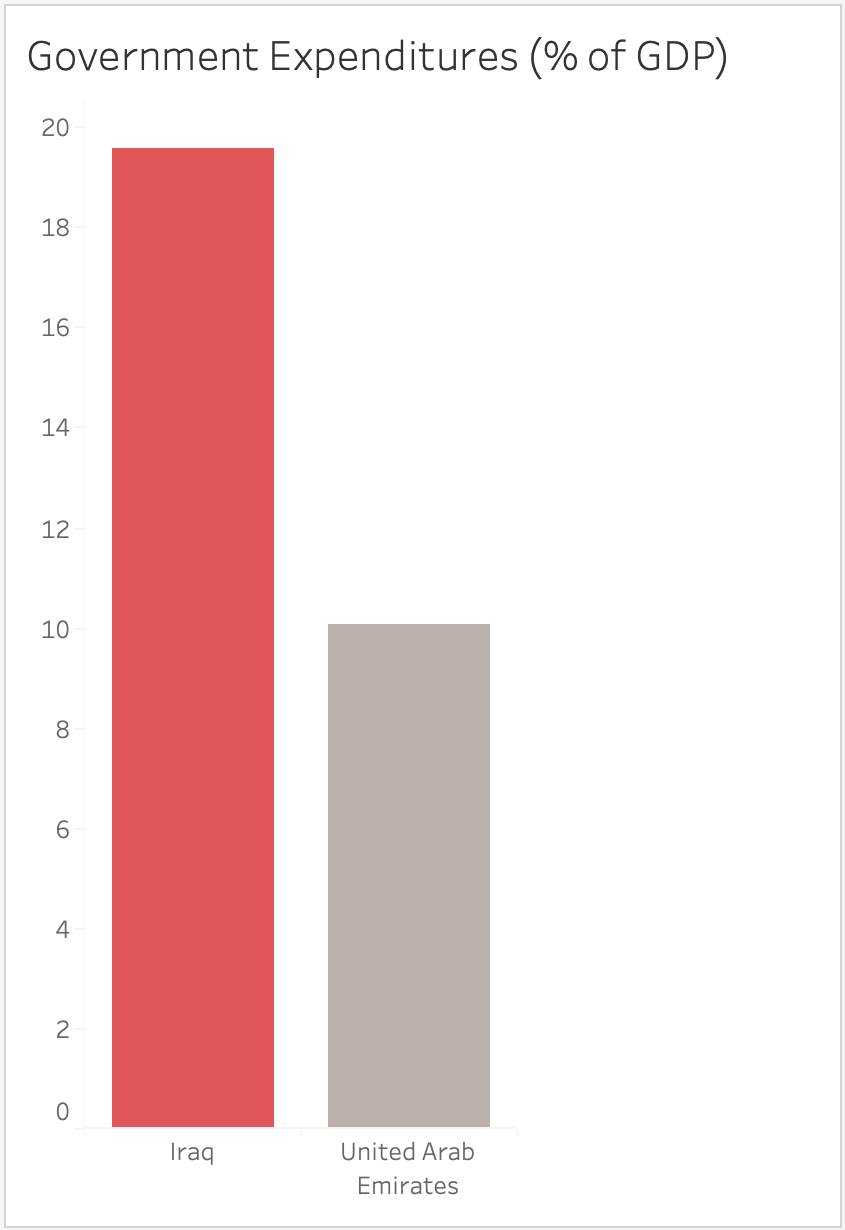

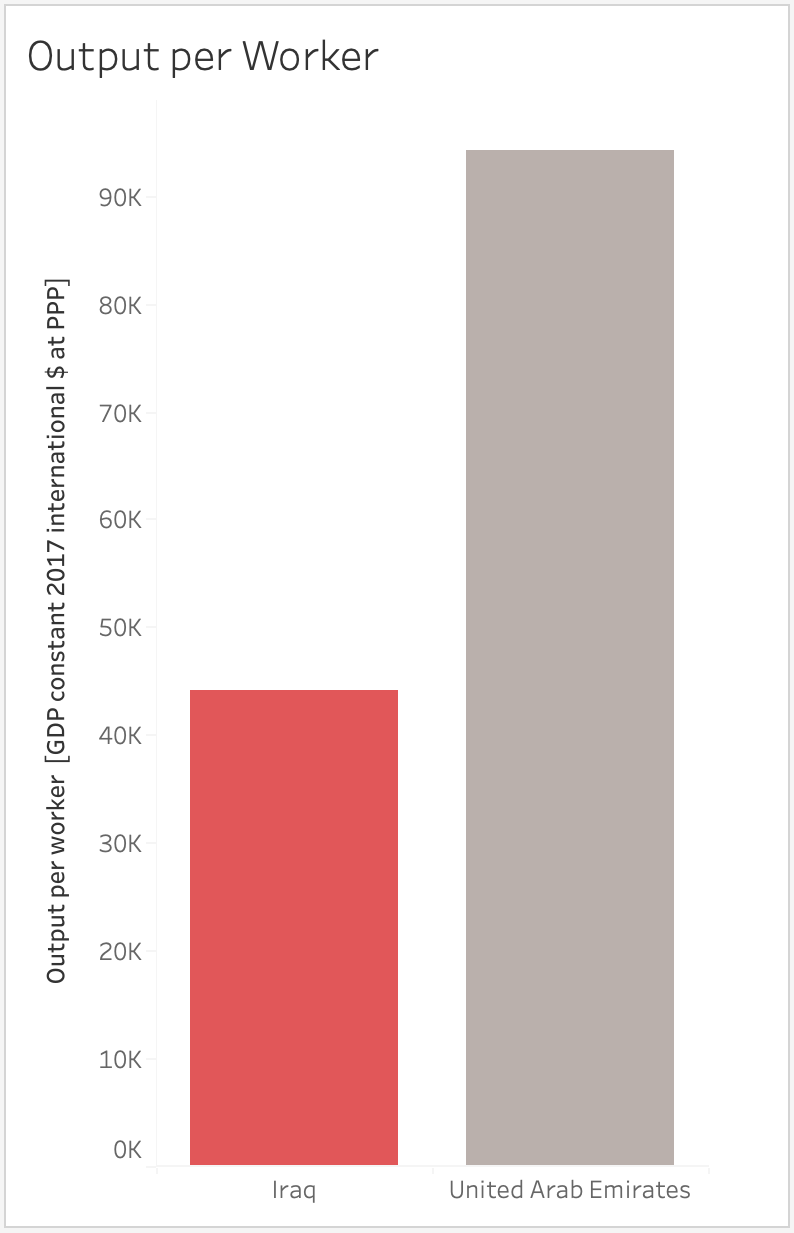

In comparison, the UAE ranks 16th on the “Ease of Business” scale, and it takes 1.5 days on average to register property. It also takes 47.5 days to get construction permits, nearly a third of how long it takes in Iraq. Their government expenditure levels are half of what Iraq’s are, whereas the average worker’s productivity value is nearly double.

Where do we go from here? For starters, digitalizing the public sector, something that is already underway in the Kurdistan Region, albeit off to a slow start, can help lower redundant employment positions, all while increasing productivity levels. A digital transformation will also pave the way for a simpler business start-up registration process, making it easier for entrepreneurs and businesses to take off, attract foreign investment, and grow the private sector.

Another solution, which in my opinion is a byproduct of digital transformation of government processes, is the expansion of the private sector. Unless the average citizen acknowledges the dependency oil creates on the economy, and the finite (and frankly, volatile) nature of this resource, Iraq will not be better off than it is today.