by Elie Chebli, in collaboration with the Economics Student Society

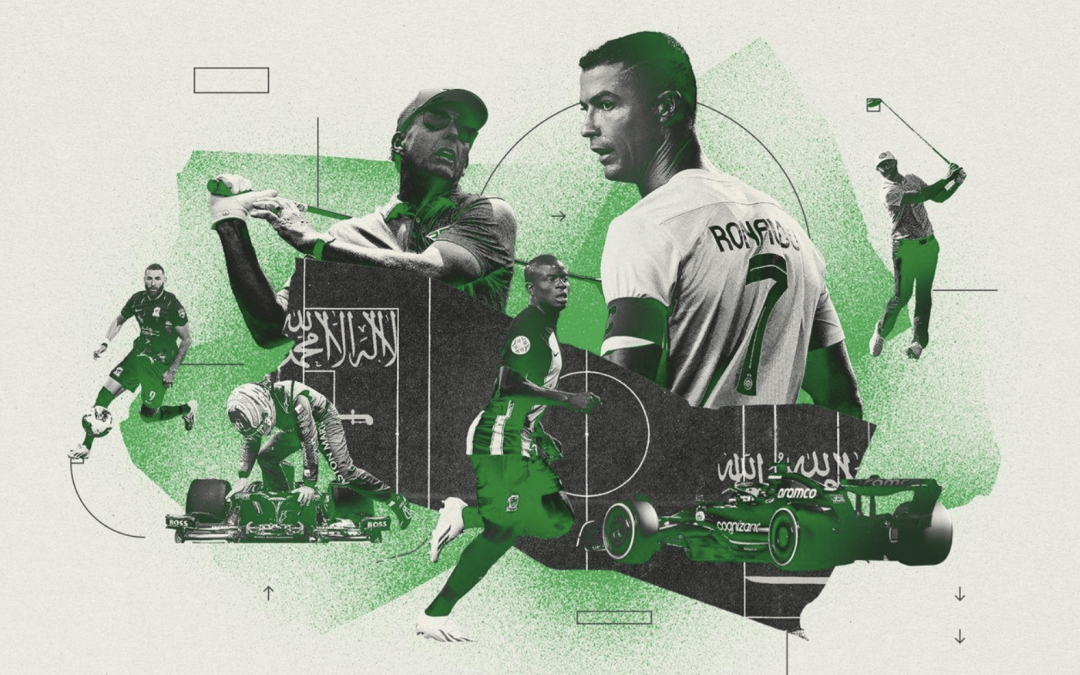

Countries around the world, particularly the Gulf states rich with oil, are spending billions of dollars every year on sports stars largely past their prime to play in new local leagues they are setting up. These countries are no strangers to lavish and often poorly planned spending. However, unlike skyscrapers and giant shapes in the deserts, the economic logic of spending fundamentally limited Petrodollars on athletes is even harder to map out.

To help illustrate the picture, sports is a massive industry worldwide. The sporting industry in the USA alone produces more economic output than the 70 largest economies in the world. There is another aspect to it, which is entertainment, and the entertainment industry has proven itself to be far from a predictable or reliable model to build an economy around.

Major sporting events like the Olympics and the World Cup have failed to generate positive economic outcomes for the countries hosting these events. In the case of the most recent World Cup hosted by Qatar, the event mostly harmed their reputation on an international scale due to controversies over the rights and treatment of the workers who put the event together. Additionally, the strict local laws and customs were incompatible with Western businesses and audiences, like the strict alcohol regulations that sparked widespread outrage.

Even countries that have a long history and strong cultural connection toward globally viewed sports, like the English Premier League, have struggled to maintain teams that are profitable in the long run. The Gulf states do need to diversify their economy to lessen their dependency on a limited resource that fluctuates in price every day on global markets, and it is a positive step to see them making efforts toward that goal.

Nevertheless, paying billions of dollars over the market price to host sporting events that are unprofitable remains a questionable strategy. Realistically, it would make much more sense for that money to be spent on developing other industries that could replace oil and gas long term, or at the very least invested in a sovereign wealth fund that makes low-risk investments to provide revenues to the countries in the future.

It is difficult for an external observer to look at these decisions and think that it is anything other than the proverbial smooth-brained dictator who really likes golf, Formula One, or football and is using their unchecked mountains of petrodollars to buy their own personal playthings. Evidently, there exists a real possibility of such a scenario, and economists pool in to justify the shortsighted decisions of the people in charge. However, there may be a real strategy to these record-breaking contracts, which have the potential to make a major impact on these economies during their transition over the coming decades.

Therefore, what is the motivation behind spending billions of dollars to develop a sports league in a country with no history of sports? Could this seemingly reckless spending accelerate the underlying economic problems in these countries? And finally, is there a genuine economic outcome where this public expenditure is justified? Most of the attention recently has been focused around contracts given to football or soccer players from teams in the Saudi Arabian Pro League. This is not a particularly large or well-known league internationally, and it does not attract the same viewership or sponsor dollars as better-known competitors in Europe or even the US. As a result, the money to pay for these headline-grabbing contracts is coming from the Saudi Arabian government.

The teams making these offers are majorly owned by something called the Public Investment Fund, which is one of Saudi Arabia’s sovereign wealth funds. The Gulf states, in particular Kuwait, the UAE, and Saudi Arabia, all have their own sovereign wealth funds, which in theory take oil revenues and use them to invest in the future of the Kingdom. Unlike the funds from France, Norway, and even China, the Gulf states have been widely criticized for being very opaque with their operations.

Public information about where they invest, outside of a few big purchases that attract a lot of attention, like the contracts to these sports people and occasionally entire teams inside and outside of the countries themselves. The Public Investment Fund of Saudi Arabia also owns Newcastle United, which plays in the much larger English Premier League.

This poses several questions: What is the logic here? Is there any way that this is a sensible economic strategy? The first explanation is that large sports teams are just businesses in a surprisingly large industry, and investment into these international and domestic teams is no different from regular investment into regular companies like every other sovereign wealth fund does. The only reason that Saudi Arabia or Qatar paying large sums to obtain footballers and golfers is any different from Norway buying shares in Apple is that regular people care more about sports stars and teams than they do about financial securities.

Even disregarding that matter of fact, sports teams are not ideal investments; many of them are run at a loss by extremely wealthy people who just want to own goods and services that they grew up enjoying. They may be businesses like any other, but they are normally bad investments, and the managers of sovereign wealth funds would know that. Fortunately, though, it might not matter if those returns are received directly through the investment fund itself. The stated goal of these funds is to build national income diversity beyond just resource revenues, and that is best achieved by building local industries.

These sports teams could, theoretically at least, build a part of a major push for tourists and international business dollars. Newcastle United’s largest sponsor is Selah, a company that owns and develops the sports events industry primarily in Saudi Arabia. Even if the team itself never generates any money, the nation of Saudi Arabia will benefit in other ways by building itself up as a destination for sports fans all over the world.

Industries like this attract a lot of employment and require many businesses to accommodate for all of the supporting industries that spring up around it and have the potential to work in line with the general strategy of replacing oil revenues with revenues generated from being a regional business and tourist hub. With the addition of megaprojects, low taxes, and a convenient central location, it is an attractive offering to businesses that want to, at the very least, get a cut out of this seemingly reckless spending. This would encourage locals or even outsiders to build hotels, open restaurants, and everything else in between.

Saudi Arabia, in particular, is highly unlikely to ever profit directly from these record-breaking sports deals, but in the inevitable race against time that they find themselves in, spending a tiny fraction of their resource revenues on an industry that could speed up their transition to a self-sustaining economy. However, many problems arise – such as migrant labor wouldn’t have gotten the attention they’re currently getting if it wasn’t for the World Cup in Qatar. Nor would the conflict in Yemen without Formula One in Saudi Arabia.

If these countries want to make these investments work and open up to the world, then they’re going to have to address these issues where the alternative is hoarding their oil wealth and remaining stuck in their old ways.

Sources

Economics Explained, Bloomberg

Great article 👏👏