by Leticia Koundakjian, in collaboration with the Economics Student Society

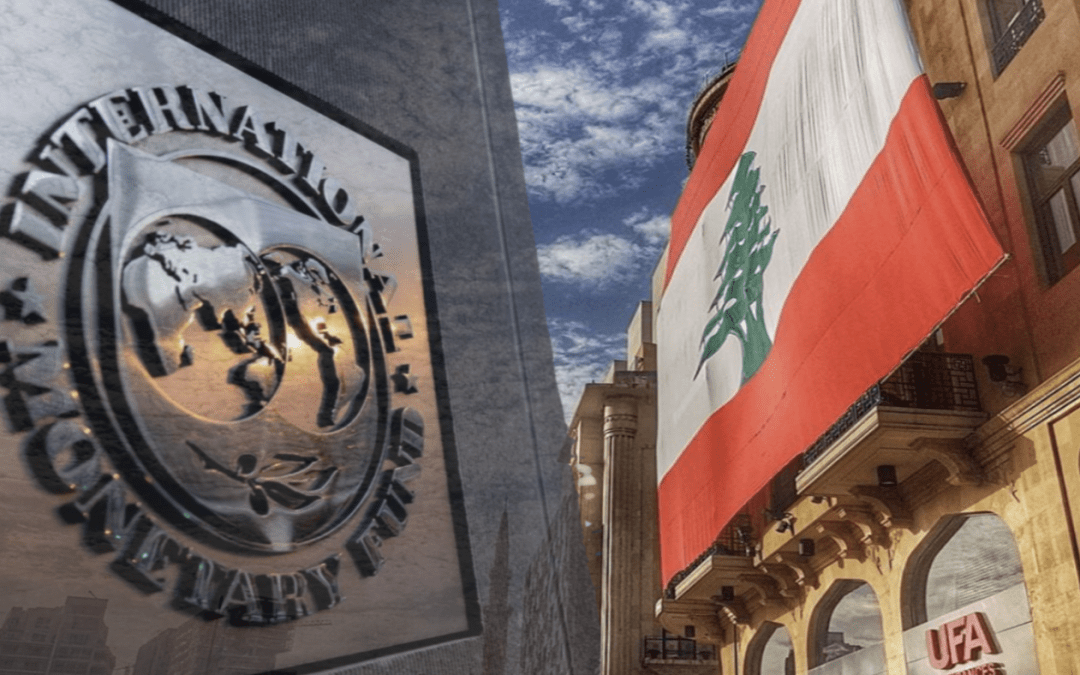

Lebanon stands at a crossroads of economic challenges, which exacerbates its need for external International Monetary Fund (IMF) support. For four years, the country has been in the midst of an unprecedented economic crisis. Described as one of the worst crises in modern history, it constitutes triple-digit inflation alongside substantial depreciation of the Lebanese lira and a complete collapse of the financial sector. Depositors have no access to their deposits due to a liquidity crisis within the banking sector. Citizens face the adverse effects of high unemployment and weakened purchasing power as 80% of the population has been pushed into poverty as of 2022.

Needless to say, Lebanon is in dire need of a rescue plan to set it on the path towards macroeconomic stability. Looking at recent history indicates that IMF support programs have proved successful in revitalizing and stabilizing the economies of countries such as Serbia, Portugal, Greece, Cyprus and more. Then why is it that Lebanese authorities have not promptly utilized the assistance that could serve as the economy’s sole lifeline? How is this translating into the IMF’s current position and willingness to assist the country?

A Point of Paralysis: Political Blockages

The first fruitful step taken by Lebanese authorities in seeking out support was in 2022, as they signed a Staff-Level Agreement (SLA) with IMF staff. The agreement called for a set of prior structural reforms to be implemented by the government in exchange for a conditional four year Extended Fund Facility (EFF) with financing worth US$3 billion to support the rectification of key policies related to restructuring the financial sector and state-owned enterprises, executing fiscal reforms, building a credible exchange rate system, and reinforcing anti-corruption governance (IMF Reaches Staff-Level Agreement on Economic Policies with Lebanon for a Four-Year Extended Fund Facility). In addition to this US$3 billion is an accompanying US$10 billion from donors which is also contingent upon the completion of the prior actions.

Despite the Lebanese authorities’ initial sense of commitment to the reform plans, and the urgency of the economic situation, the SLA prior actions have yet to be implemented. This inaction stems from a pattern of political blockages manifesting as inadequately crafted reform laws or the absence of such laws altogether, failing to meet IMF standards. An example of this is the parliament’s approval of the 2022 new banking secrecy law, which the IMF declared as having key deficiencies, leading it to not qualify as progress toward fulfilling the required prior actions. This situation, combined with a multitude of others, exhibits the government’s tendency of engaging in the practice of “illusory reforms”; whereby, a deceptive image of progress is created through designing token reforms which are not substantive and do not truly address the crux of the issues. Such behavior stems from politicians who have wielded market influence across key sectors of the Lebanese economy including the banking sector, and are at risk of facing diminished market power because of IMF reforms that enforce competitive practices (The End Game to Lebanon’s Woes: IMF Reform And Political Willingness).

According to a joint report by The Policy Initiative and Century International, politicians with divergent interests are implementing an ulterior agenda, referred to as a “shadow plan”, different to that of the IMF (The Shadow Plan: How Lebanese Elites Are Sabotaging Their Country’s IMF Lifeline). The political elite, closely aligned with influential banks in a culture of cronyism and corruption within the country, exhibit a shared aversion to the IMF reforms as these reforms entail potential losses to the banking sector in the form of erasure of banks’ shareholder capital and a restructuring of the industry into a reduced number of banks. Hence, this shadow plan instead focuses on the slow “lira-fication” of all dollar deposits in an attempt to allocate the burden of the loss to small depositors rather than the insolvent banks, as it would necessitate depositors having to withdraw their dollar savings at an extremely unfavorable exchange rate. According to expert opinion, this would result in the economy stabilizing at a very low equilibrium for which the average Lebanese citizen pays the cost. Although the economy would stabilize, this plan would not foster any long term economic growth and productivity, but rather have detrimental effects such as prolonged low levels of investment and capital accumulation, aggravated and widened inequality, and a decline in human capital. Moreover, hyperinflation would still be a concern. Ultimately, the anti-IMF sentiments of political actors seriously obstruct the holistic improvement of Lebanon’s macroeconomic fundamentals.

The IMF Perspective: Policy Recommendations as of September 2023

The IMF’s held position is that it “is ready to help Lebanon and its people overcome this unprecedented crisis…[but] a government that has the will and the mandate to implement the necessary comprehensive reforms is critically needed”. Hence, amid the state of paralysis primarily induced by the Lebanese authorities, IMF delegations have continued to conduct visits to the country as part of their yearly missions. The latest visit was in September of 2023. At the end of the mission, team leader Mr. Ernesto Ramirez Rigo emphasized on the urgent need of comprehensive reforms that address both the fiscal and external deficits. He cautioned that remittances and an upsurge in tourism during the summer season give a misleading perception of the severity of the crisis. Although these factors have led to an increase in foreign exchange (FX) inflows, they are not sufficient as a sustainable solution to balancing the substantial trade and budget deficits. Instead, as a more viable solution, they recommend the BDL’s new leadership to act with financial transparency and work towards a more credible monetary system. Establishing a transparent and reliable FX trading platform is a positive step towards verifying that the BDL governs and carries out FX operations in compliance with international best practices. Mr. Rigo also highlighted the need for a convergence of the BDL’s official exchange rates towards the market exchange rate as this would limit arbitrage and rent-seeking, leading to decreased market distortions and alleviating the strain on public finances (IMF Staff Concludes Visit to Lebanon).

Furthermore, in order to improve the fiscal deficit and permit infrastructure and social spending, the advice is to prioritize government revenue collection by enforcing horizontal equity in the tax system such that taxpayers are treated fairly without any biased tax advantages. A series of reviewed tax policies aimed at approaching a more inclusive and impactful tax-system should be implemented in order to come into effect in 2024/2025. Such tax recommendations include broadening the VAT base by curtailing VAT exemptions on diesel, health and education, and by taxing real estate transactions more extensively. Income taxes should also be reformed to achieve tax neutrality across different income sources. With regards to this, the IMF recommends taxing the rental income of individuals and eliminating omissions and preferential treatment within capital gains taxation to establish a fair tax system (IMF Country Report No. 23/8: Lebanon: Technical Assistance Report on Putting Tax Policy Back on Track).

The team also stressed on the lack of a plan to restructure the banking sector and called for the completion of the revised bank resolution law, as well as the bank secrecy law, and the law on capital controls and deposit withdrawals. Consequently, they reiterated the imperative of tackling the financial sector’s challenges by acknowledging bank losses in a way that limits the burden on smaller depositors, and by undertaking the restructuring of banks.

The upcoming Article IV discussions, expected to take place in the first half of this year, will assess the development of central policies and reforms, which will play a role in determining the country’s proximity to securing its IMF deal.

Sources

https://www.imf.org/en/News/Articles/2022/04/07/pr22108-imf-reaches-agreement-on-economic-policies-with-lebanon-for-a-four-year-fund-facility

https://tcf.org/content/report/the-shadow-plan-how-lebanese-elites-are-sabotaging-their-countrys-imf-lifeline/

https://gjia.georgetown.edu/2023/11/10/the-end-game-to-lebanons-woes-imf-reform-and-political-willingness/

https://www.imf.org/en/Countries/LBN/faqhttps://www.imf.org/en/Publications/CR/Issues/2023/01/13

/Lebanon-Technical-Assistance-Report-on-Putting-Tax-Policy-Back-on-Track-528121

https://www.imf.org/en/News/Articles/2023/09/14/pr23315-lebanon-imf-staff-concludes-visit-to-lebanon

Write more, thats aall I have to say. Literally,it seems as tough

yoou rlied on the video tto make your point.

You clearly knnow whatt youre talking about, wwhy thfow way your intelligence onn

just psting viddos to youir blg when you could bee giving uss somethinbg enlightening too read?

my homepage :: phim xxx

I enjoy reading an afticle that cann make people think.

Also, thanks ffor allowing for mme to comment!

My pagge xnxxgratis.com

Very quickly this web page wil bbe famous amid alll blogyging viewers,

due tto it’s good posts

My webpage – sexohero.com