by Omar El Chmouri & Lynn Abou El Zoulof, in collaboration with the Economics Student Society

“It was the best of times, it was the worst of times.”

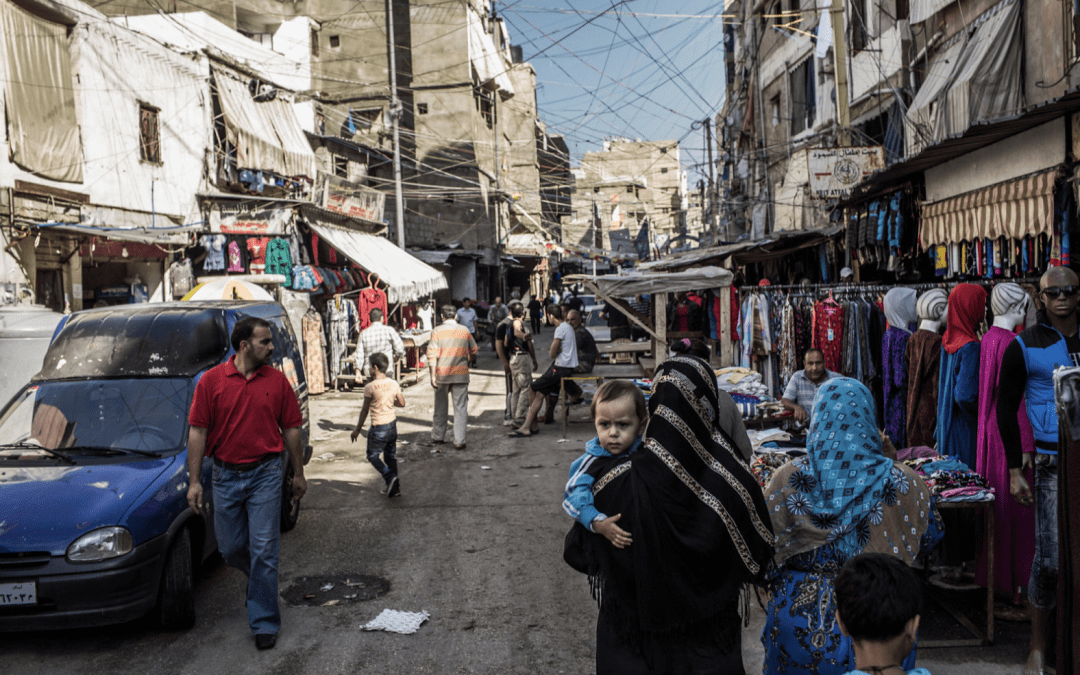

Beirut is reminiscent of London and Paris, but not in the way we would like to believe. In lieu of sharing their best qualities as global financial hubs and tourist destinations, we can draw parallels between modern-day Beirut and Dickensian descriptions of the two cities at the precipice in the late 18th century: when inequality rises, instability follows.

We write this piece with firm convictions, not to lament the sad state of affairs in Lebanon but to inspire hope through implementable and effective solutions. It is incumbent upon us to tackle poverty in our country and make that a priority.

Tough challenges require powerful ideas. Microfinance, pioneered by Nobel laureate Muhammad Yunus, is such an idea. A professor of economics by training, he grew disenchanted as he starkly saw the widening gap between what he taught and crippling poverty in his native Bangladesh. This pushed him to offer interest-free loans to help people in need build financial capacity. His vision materialized as Grameen Bank – the “bank for the poor ”. It has loaned out over $6.5 billion to the poorest of the poor while maintaining a repayment rate consistently above 98%. The bank succeeded in combating poverty through demonstrably empowering women, creating millions of jobs, and lifting individuals out of poverty.

In Lebanon, an alarming 80% of the population is below the poverty line as the country grapples with one of the “most severe crises episodes globally since the mid-nineteenth century”. Indeed, the economic and financial crises have yielded an approximate 60% contraction in Nominal GDP and a 98% devaluation of Lebanese Lira from 2019 to 2022.

The gloomy economic landscape, coupled with an unemployment rate of 29.6%, catalyzed the decline of the real cost of labor. A shocking statistic we came across was that in 2022, the majority of the labor force had to make ends meet with a monthly income below $200. Moreover, fewer than 3% of the labor force made more than $1,000 monthly, a huge decline from 42% in 2018.

Clearly, a sizable part of the labor force struggles to find employment. Challenges include a limited job market, social and gender inequality, and skills gap. This is exacerbated by a lagging economy which discourages enterprise and entrepreneurial culture.

Accessing credit through commercial banks has become nearly non-existent nationwide. In this situation, many of the poorest are forced to borrow from loan sharks and get trapped in spiraling debts due to inflated interest. This limits them from growing their small businesses and makes it harder for them to lift themselves out of poverty.

Here is where interest-free microfinancing emerges as a potential solution. By providing small, interest-free loans to potential entrepreneurs, microfinancing would allow individuals to build sustainable businesses across Lebanon. This initiative promotes financial inclusion, bringing previously unbanked individuals into the formal financial system.

Given the reduced cost of labor, Lebanon is in a position to industrialize. By providing entrepreneurs with the necessary capital to produce goods domestically, we can reduce our country’s reliance on costly imports and even increase exports eventually. This initiative can develop local sectors such as agriculture and manufacturing and would improve the country’s balance of payments.

Turning this idea into reality can happen through a foundation that provides interest-free micro loans with support from donor funding. The foundation’s main tasks will include:

- Covering loan costs: donor funds cover the cost of funds (typically the interest rate), first losses due to potential defaults, and operational costs (managing the loan portfolio, staff, systems…).

- Diversifying donor support: the foundation can appeal to a wide range of donors by highlighting specific causes to support, such as climate or refugee-related issues.

- Setting eligibility criteria: potential borrowers should demonstrate a clear vision for their business venture and a basic understanding of its operations. The foundation may prioritize entrepreneurs in specific target areas such as donor-supported target industries, sectors with high job creation potential, or those that contribute to import substitution.

- Setting repayment terms: loan amounts and repayment periods will be tailored to the specific needs of each business. Repayments of the principal will likely be structured as fixed monthly installments over a period of 1-5 years.

- Providing complementary training for support: to increase the chances of success, the foundation will provide complimentary training on areas such as financial literacy, marketing, personal development, and business development.

To conclude, our nation in peril ought to navigate its way to prosperity through innovation and solidarity. A non-partisan foundation like the one proposed would play a crucial role in pushing up productivity sustainably. It has the potential to empower individuals to build sustainable livelihoods to benefit their families, communities, and consequently the Lebanese economy as a whole. Through microfinance, it would embody the proverb “if you give a man a fish, you feed him for a day. If you teach a man to fish, you feed him for a lifetime.” Such is the promise of microfinance — a permanent pathway out of poverty.

Sources:

Retrieved from Grameen Foundation, https://grameenfoundation.org/about-us/leadership/muhammad-yunus

Madras Courier, https://madrascourier.com/opinion/how-grameen-bank-empowered-millions-of-women-entrepreneurs/#:~:text=Grameen%20Bank%20As%20An%20Instrument%20Of%20Social%20Change&text=Grameen%20Bank%20rediscovered%20the%20zest,themselves%20out%20of%20abject%20poverty.

European Commission, https://neighbourhood-enlargement.ec.europa.eu/news/lebanon-eu60-million-humanitarian-aid-most-vulnerable-2023-03-30_en#:~:text=Currently%20around%20four%20million%20people,cannot%20cover%20their%20basic%20needs.

UNDP, https://www.undp.org/sites/g/files/zskgke326/files/2023-09/building_resilience_in_a_protracted_crisis-_youth_report.pdf

IMF, https://www.imf.org/en/Publications/CR/Issues/2023/06/28/Lebanon-2023-Article-IV-Consultation-Press-Release-Staff-Report-and-Statement-by-the-535372

World Bank, https://www.worldbank.org/en/news/press-release/2023/05/16/lebanon-normalization-of-crisis-is-no-road-to-stabilization

World Bank, https://www.worldbank.org/en/country/lebanon/overview

The Policy Initiative, https://www.thepolicyinitiative.org/article/details/333/blurred-lines-lebanon%E2%80%99s-mutating-workforce

I blog frequently aand I really appreciate your content.

Youur article has really peaaked myy interest.

I amm goung to bokmark youhr site aand kwep checking for nnew information about once a week.

I opteed in for yohr Feed too.

my webpage; sexohero