National Debt & Population Income

Does a Country’s Borrowing Policy Affect its Population’s Income level?

The Case of Lebanon

DOLLAR? LBP?

WHAT’S THE EXCHANGE RATE TODAY?

DISCOUNTING CHECKS? AT WHAT RATE?

WHAT???? 20%????

THIS MEANS I’M LOSING 80% OF MY MONEY!!!

I WAS DOING OK BUT NOW I CAN BARELY MAKE ENDS MEET…

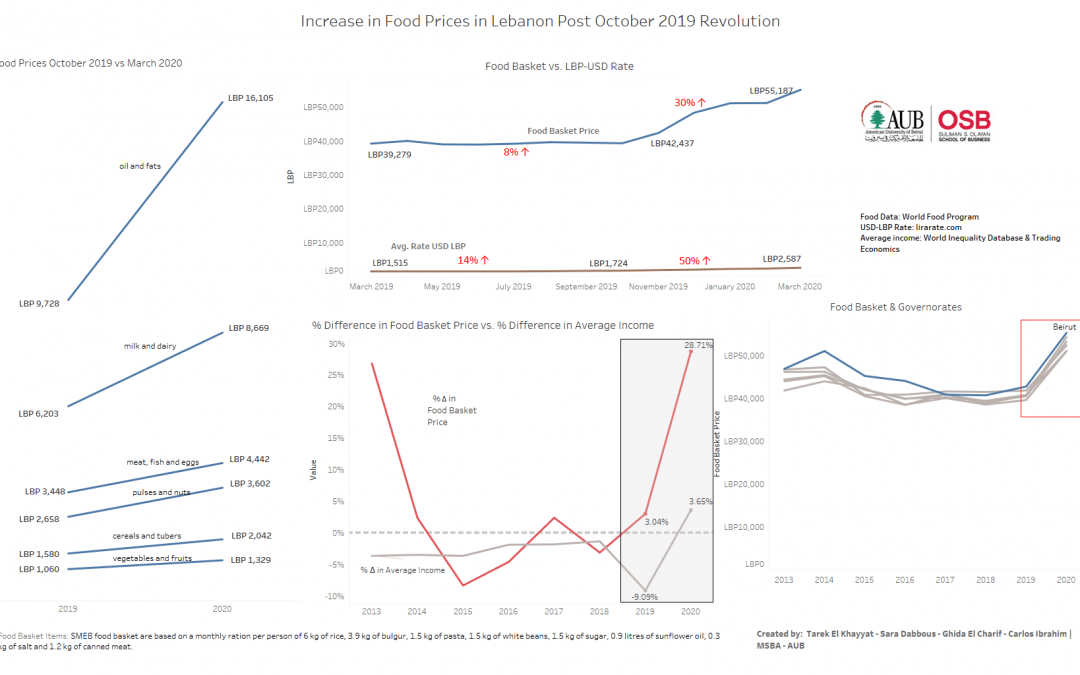

This has unfortunately been the sad reality that

theLebanese people have been living for since

October of 2019.

WHY?

Because a Banking | Financial | Currency | Crisis

Made a Huge Bubble Burst!

BUT HOW DID WE GET HERE?

Lebanon has had a budget deficit for over 20 years

and has been borrowing from external parties

for as long as we can remember.

So, as Lebanese citizens, we are born indebted.

A country’s national debt affects its population’s income level:

-

Growing debt has a direct effect on economic opportunities

-

If high levels of debt crowd out private investments, workers would have less to jobs do and therefore earn lower wages

Countries with LOWER DEBT exhibit HIGHER INCOME levels per capita.

SO HOW HAS LEBANON’S DEBT BEEN CHANGING OVER TIME?

WHAT CAN WE DO TO MAKE THINGS BETTER?

Potential Solutions include but are not limited to:

-

Supporting Production and Services Sectors leading to more Job Creation and eventually More Wages

-

Improving Trade Agreements leads to more exports which would Reduce Budget Deficits and make the country economically healthier

-

Attracting Foreign Direct Investments by providing a healthy capital market (ex: improving Reporting Practices) which leads to More Investments & More economic opportunities, More Jobs and eventually More wages

IS THERE PROOF?

Countries with Open Trade Policies seem to have higher income levels

Countries with Updated Reporting Practices also have higher income levels

SO, WHAT ARE THE RECOMMENDATIONS?

STOP borrowing from international Agencies

CONTROL High National Debt Levels